Our Blog

1️⃣Top 5 Bookkeeping Tips for Small Business Owners

Category: Accounting Tips

Content:

Keeping accurate financial records is essential for every small business. Good bookkeeping helps you make informed decisions, stay compliant, and maintain control over your finances.

Here are five tips to keep your books in order:

Separate Personal and Business Accounts

Keep personal and business finances separate to avoid confusion and simplify reporting.Use Accounting Software

Invest in reliable accounting software to track income, expenses, and reports automatically.Track Every Expense

Record all transactions, even small ones. Missing expenses can affect tax deductions and financial clarity.Reconcile Accounts Monthly

Compare your books to bank statements regularly to identify errors and maintain accuracy.Keep Digital Records

Scan and save receipts electronically to reduce clutter and ensure quick access when needed.

Conclusion:

Accurate bookkeeping saves time, reduces stress, and provides a solid foundation for financial growth. Following these tips ensures your small business stays organized and financially healthy.

2️⃣ Maximize Your Tax Deductions: What You Might Be Missing

Category: Tax Advice

Content:

Many taxpayers leave money on the table by overlooking deductions and credits. Our goal is to help you identify opportunities to reduce your tax liability while remaining fully compliant.

Common Personal Deductions:

Charitable donations

Education expenses

Home office or work-from-home costs

Business Deductions:

Office supplies and equipment

Mileage and vehicle expenses

Home office deductions for entrepreneurs

Retirement Contributions:

Maximize contributions to IRAs, 401(k)s, and other retirement accounts to reduce taxable income.

Conclusion:

Careful planning and awareness of available deductions can significantly reduce your taxes. Let us help you navigate the process for maximum savings.

3️⃣ How to Choose the Right Business Structure for Your Startup

Category: Business Guidance

Content:

Selecting the right business structure is a critical step for new entrepreneurs. The decision affects taxes, liability, and long-term growth.

Key Considerations:

Legal and Tax Implications: Different structures have distinct tax benefits and reporting requirements.

Liability Protection: Corporations and LLCs offer limited liability; sole proprietorships do not.

Administrative Requirements: Some structures require formal meetings, filings, or records.

Conclusion:

Choosing the right structure lays a strong foundation for your business. Professional guidance ensures you make informed decisions tailored to your goals.

4️⃣ Retirement Planning Basics for Individuals and Small Business Owners

Category: Financial Planning

Content:

Planning for retirement early is essential for long-term financial security. Even small contributions today can have a significant impact in the future.

Understand Your Accounts:

Traditional and Roth IRAs

401(k)s and employer-sponsored plans

Set Goals and Strategies:

Determine how much you need to save to maintain your lifestyle

Adjust contributions regularly based on income and expenses

Investment Options:

Diversify your portfolio to balance risk and growth

Consider long-term strategies that match your retirement timeline

Conclusion:

A clear retirement plan empowers you to make confident decisions today, ensuring financial independence tomorrow. Professional guidance can help you create a personalized, effective strategy.

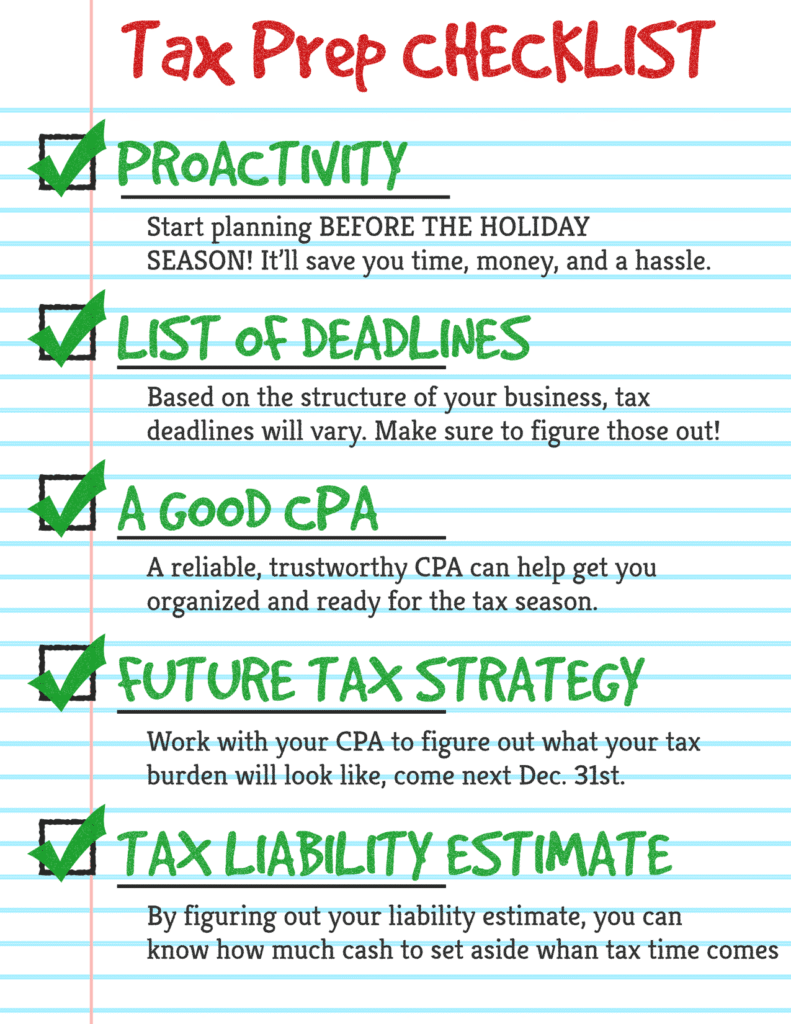

5️⃣ Year-End Tax Checklist: Prepare Now, Avoid Stress Later

Category: Tax Advice

Content:

Year-end tax planning helps you avoid surprises and maximize savings. Use this checklist to ensure you’re prepared:

Gather Documents:

Income statements, receipts, and deductions

Business and personal records

Review Estimated Payments:

Ensure your quarterly tax payments are up to date to avoid penalties.

Maximize Contributions and Deductions:

Retirement account contributions

Charitable donations

Check Tax Law Changes:

Stay informed about any changes that may affect your filing.

Conclusion:

Following a year-end checklist reduces stress and ensures accurate filing. Planning ahead allows you to take full advantage of tax-saving opportunities.